Public interest in Blockchain technology has been on the rise since the price of Bitcoin hit an all time high of $19,524 in 2017. Although the price came down and was hovering around $5,273 in April 2019, the huge media coverage of that milestone propelled this little known cryptocurrency to worldwide stardom.

The immense publicity only revealed a unique opportunity for investors but few people have understood the mechanics and technology behind Bitcoin. This article gives a hands-on approach to Blockchain technology and simplifies every aspect of this amazing innovation.

What is a Blockchain?

A Blockchain is simply a diary that is extremely difficult to alter. Let’s assume that there is a ledger in which transactions are recorded over a period of time and that all of us have access to this ledger. Every day there are transactions recorded in the ledger and after being recorded, they cannot be altered or deleted.

What it means is that all of us can see each transaction in a transparent manner and each record is safe because it cannot be changed.

What is Blockchain technology?

In a nutshell, Blockchain technology is a tool used to securely transfer ownership of units of value by proving that work has been done. This is accomplished using public key encryption in a ledger that is transparent and publicly accessible.

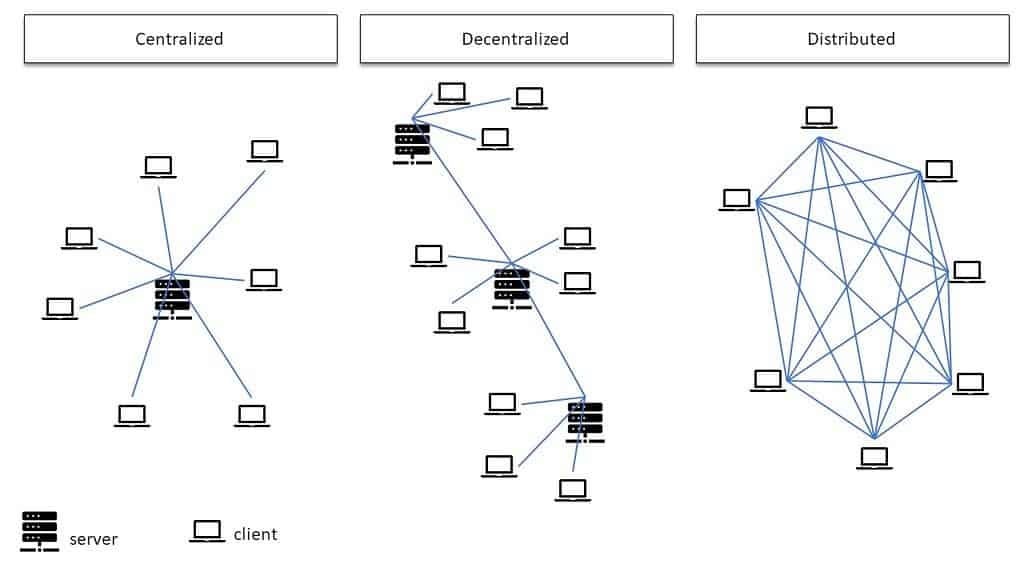

This technology depends on a system that is decentralized – does not depend on a third party and is therefore not controlled by one entity. This is unlike centralized ledgers controlled by a corporation or bank.

The use of a decentralized network means that the technology becomes more secure as the network expands.

The Mechanics of Blockchain Technology

To illustrate clearly how Blockchain technology works we shall consider a simple example as follows:

Let us assume that we have 5 people with shares in an entity. A third party will enter the details of their shareholding in a ledger and update any transactions in a sequence each time a member of the team transfers shares to another member.

A traditional ledger is centralized which means it is controlled by one entity (the third party). Any transactions are simply entered into the ledger and everyone has to refer to that single ledger to see the chain of transactions.

Now, let’s assume that we eliminate the third party and allow every member of the team to have a copy of the ledger. This is then referred to as a distributed ledger or decentralized ledger. The ledger will therefore reside on each of the 5 computers (which we shall refer to as “nodes”) owned by the members.

Since the nodes in this network are connected via the internet, a viable, transparent and foolproof method has to be found to ensure that every time a transaction takes place, all the five ledgers are updated so that there is one synchronized version across the nodes.

Blockchain technology makes it possible to update such a distributed ledger in a tamper-proof way that allows all the members to witness and validate at any given time how much value has been transferred, and to whom.

For this to happen a process known as mining is utilized by special nodes on the network. Mining is simply solving a complex calculation using a computer’s computational power (it is a response to what is referred to as “proof of work” challenge).

When a transaction is initiated by one of the members, it is published to the network. The special nodes (miners) compete to validate the transaction by looking at the previous records, determining whether the transaction can go ahead and finding a special key.

The miner who validates the transaction first, gets a reward (could be financial or otherwise).

Since the information in the ledger is accessible to all the nodes, it is simple to proceed with the calculation to validate the transaction. How fast a miner validates a transaction depends on the computational power of the node.

After the miner validates the transaction, the solution to the calculation and the special key are published to the network. For the transaction to be synchronized across the network, each node will look at the solution published and establish whether it is valid based on available records.

If a majority of the nodes approve the transaction, it is then added into the ledger using the special key. Each of the 5 ledger copies will now be synchronized.

These transactions are entered into the ledger in the order in which they occur. The nodes check to ensure a transaction is valid by inspecting the previous transaction.

Consensus and validity of transactions

Each transaction generates something called a hash. A hash is simply a string of numbers and letters that are used to represent text. For example, the following text – “member A transferred 100 shares to member B” could be represented by the hash:

91b68c712gbac73c2395881261e8ff214ca85328no60dbhkanmfojjeosur74953.

Each ordered transaction depends on the previous transaction and similarly each hash depends on the previous transaction’s hash. A small change in a transaction results in the creation of a new hash. Each node checks to make sure all transactions have not been changed by carefully inspecting the hash.

In the distributed ledger described above, any recorded transaction cannot be changed. Only new entries can be added to the ledger and updated on all computers (nodes) on the network simultaneously.

Every transaction must be approved by the nodes through an electronic vote to minimize any chance of fraud.

Since each node has a copy of the digital ledger, it checks the validity of each transaction and if a majority of nodes agree that a transaction is valid then it is recorded into a block.

Blocks

A ledger is filled with ordered transactions and when these transactions reach a certain number, the ledger is closed and forms a block (group of trustless transactions). When a given block reaches a particular number of approved transactions, a new block will be formed.

Every block is validated by a proof of work. Each time a block is formed, the nodes verify the proof of work using the hash function. The hash (solution to a proof of work) in a block is linked to the hash in the previous block. The block contains the transactions and the mathematical puzzle that had to be solved for the block to be placed on the Blockchain.

Each new block is linked to the previous block and together they form a Blockchain. A blockchain is therefore a ledger of past transactions confirmed by the network.

If someone tries to change an entry, the other nodes (computers) would not allow the change to occur because they have the original hash which must also be changed. It’s therefore impossible to forge it because it’s updated on all nodes on the network simultaneously.

As mentioned, the network is decentralized with no central computer instructing the other nodes on what to do. The Blockchain automatically updates itself every ten minutes and immediately the ledger is updated, it cannot be changed.

Proof of work

Proof of work is the placement of a transaction in a block after successful conclusion of a mathematical challenge.

When users send each other digital tokens on a network, these transactions are gathered into blocks. However, these transactions must be confirmed on the decentralized ledger.

To confirm these transactions, a complicated mathematical puzzle needs to be solved. This is done by special nodes called miners. The process of finding the solution is called mining.

After a user submits the intended transaction, miners start to work on it – this requires a lot of computational power to solve. The answer to the mathematical puzzle is called hash.

Solving the problem requires a lot of accurate work within the following parameters:

- The problem shouldn’t be too complicated because generating a block will take a lot of time and this may stall transactions.

- The problem shouldn’t be too easy. If the system allows such simple puzzles, the process may be prone to vulnerabilities and can be misused.

- The solution needs to be easy to check. The nodes on the network should be able to analyze if the calculations are correct to achieve consensus. If the solution is not easy to check then some nodes will have to trust other nodes which is not allowed – every process on a Blockchain must be transparent.

The complexity of the mathematical puzzle depends on the network load, number of users and many other factors. To prevent fraud, the hash (solution) of each block contains the hash of the previous block. The mining difficulty is recalculated every 2,016 blocks to ensure the time needed to mine one block is kept at 10 minutes.

Validating a transaction through a proof of work is a random process that uses a lot of trial and error. The low probability of such a process requires the use of extensive computer processing time to generate a valid proof of work.

Mining

We saw earlier that to update a distributed ledger in a tamper-proof way, transparent validation is required to transfer value to another user. This job is done through mining.

Mining is the process of updating (adding) transaction records to a Blockchain’s public ledger. This process is done by special nodes known as miners. It starts with the submission of a proof of work problem by a user.

The process is called mining because it’s similar to the physical mining of other commodities which requires intensive use of resources to extract new units and is painfully slow.

A miner is a computer system involved in the computations for “mining.” A normal PC can be used for this process but since it is complex and consumes a lot of energy, powerful computers known as ASICs (Application-specific integrated circuits) are used for this task.

During the process, miners compete with each other in an attempt to guess a specific number and whoever does this first, gets to update the ledger of transactions.

The miner who updates the ledger of transactions (the miner produces a block that is approved by an electronic consensus of nodes on the network) receives a reward. For example, on the Bitcoin network, a successful update on the ledger is rewarded with 12.5 Bitcoins.

Mining essentially chronicles the history of transactions so that it is impossible for anyone to modify them – the nodes download and verify the ordering of events on the Blockchain by consensus. The mining process achieves the following:

- Verifies the legitimacy of a transaction and prevents fraud

- Creates new blocks by rewarding miners for performing tasks (solving a mathematical puzzle called “proof of work problem”).

The are also paid transaction fees by users as an incentive to prioritize their proof of work problems. As the amount of transactions increases, the transaction fees also go up.

The mining sequence is as follows:

- Users initiate transactions by sending each other digital tokens.

- To complete the transaction, miners compete to solve a mathematical puzzle known as proof-of-work problem.

- A reward is given to the first miner who solves each block’s problem.

- The solution is verified as legitimate by nodes on the network through consensus.

- Verified transactions are then stored in the public Blockchain.

Proof of work is used in many Blockchains like Bitcoin, Ethereum and many others.

Characteristics of Blockchain

The technology behind Blockchain is unique in many ways which make it suitable for a myriad of applications. The characteristics of Blockchain represent the principles on which this technology is built.

In an earlier example we saw how any miner in the network can validate a transaction. This is possible because of the transparent nature of Blockchain. This characteristic and others together make this technology a game-changer.

The foundation of Blockchain is based 3 major principles namely decentralized system, immutability of records and transparency, Let’s look at them in detail:

Distributed Ledgers (Decentralized system)

Communication between nodes in a Blockchain happens directly (peer to peer transmission) rather than through some centralized system. Information travels quickly through the network since everything is stored on each node, making it easy to share what is happening with an adjacent node.

The nodes that are distributed throughout the world store the information simultaneously rather than in one centralized place. The information is basically owned by everyone on the network.

The peer-to-peer network is a collection of nodes which are interconnected to one another through the internet. Such a decentralized system ensures that the computers (nodes) on the network share the workload between themselves, increasing speed and efficiency.

This is why a peer-to-peer network is very effective for file sharing unlike a centralized system which can be controlled (let’s say through censorship) and may be slowed down or entirely cut off if the server malfunctions.

In a peer-to-peer network, the network never turns off since if one of the peers drops out, the rest take up the challenge to keep the network alive.

The advantages of a decentralized system include:

- There is no risk of data loss due to a system outage. Basically, there is no one point of failure capable of bringing down the entire blockchain.

- The likelihood of a hacker taking control of the network is negligible.

- Everyone on the network owns the information and they do not need to go through a third party.

Immutability of records

We saw earlier that a transaction on Blockchain is linked to a previous one through the hash. Within Blockchain, once a transaction has been validated and recorded on each node across the network, it cannot be altered.

Since the transactions are linked in chronological order, changing one entry will mean changing all other entries and subsequently recalculating all the hashes. It is therefore impossible to change a transaction’s record.

The cryptographic hash function provides a secure way that links every transaction to the previous one and creates reliability in blockchains.

The records on a blockchain are arranged chronologically, visible to all the nodes on the network and are permanent.

Transparency

All transactions on Blockchain can be seen by all the nodes on the network. Although the real identities of users are masked using cryptography, public addresses are linked to all transactions and their hash values.

The Blockchain displays a list of transactions between addresses although users are free to share their identification if they so wish. This system guarantees the privacy of users but not their transactions.

This is a great way to promote honesty because anyone on the network can look at all the transactions that have been validated and see their hash value.

This is called a trustless and distributed consensus system. In this scenario, you do not need to trust in a third party for your transaction to proceed.

In a centralized system like a bank, when money is transferred from one account to another, the ledger that stores the history of transactions is retained by the bank. It is private and users cannot see the balances of each account. They rely on the bank (third party) to do the right thing.

In blockchain, everyone has a copy of the ledger and can verify the transactions and the balances in every account. They do not need a trusted third party. It is a trustless system that is transparent throughout the network.

Such levels of accountability are unprecedented in modern history. Blockchain technology may become the next frontier in bringing sanity in the financial markets.

What’s the difference between Blockchain and Bitcoin?

We have discussed Blockchain and the fundamental principles that define this technology. However, there is some confusion in the use of the terms blockchain and Bitcoin with some people using them interchangeably.

Bitcoin is the earliest and most famous application of blockchain technology. Bitcoin has been instrumental in laying the foundation for a currency system based on consensus.

Blockchain is therefore the backbone on which the Bitcoin currency and other cryptocurrencies are built.

Utilization of blockchain in the modern economy

The ability of blockchain to create value and validate digital information gives this technology the potential to be applied in numerous sectors. This has created a lot of interest from various industry leaders with cryptocurrency taking the lead.

Areas of interest are so varied and applications can be found in e-commerce, financial services, government and even art. Let’s look at some specific areas:

Cryptocurrency

As mentioned the first successful implementation of blockchain technology is the Bitcoin Network. Bitcoin is among the more than 1,800 cryptocurrencies with a market capitalization of more than $244 billion as of May, 2019, according to Coinmarketcap, a cryptocurrency tracking website.

Apart from Bitcoin, other popular cryptocurrencies include Ethereum, XRP, Bitcoin Cash, Litecoin, EOS, Binance Coin, Tether, Stellar, Monero and Dash.

A cryptocurrency is a virtual currency that can be used like any other currency to buy goods and services. The only difference is that it is in digital form and exists as entries in a ledger which, as we saw earlier, cannot be changed unless specific conditions are met.

This medium of exchange utilizes cryptography to ensure that the currency is secured and transactions are verified in a transparent manner.

In a system that is similar to peer-to-peer networks that are used for file sharing, this electronic cash system is not controlled by a third party (the way banks operate) but is purely decentralized.

The risk of fraudsters spending the same amount twice (double spending) is solved by the fact that the Blockchain is visible to everyone on the network and they can verify every account’s balance and the transactions that ever happened.

Each transaction on the ledger consists of the value transferred and the wallets (sender’s and recipient’s public keys) involved. A wallet is an address on the Blockchain which is represented by a public key. The public key is a user’s identity on the network.

The sender must dispatch a message of the transaction signed with their private key (a string of random numbers which must be kept secret by the wallet owner). The transaction is then broadcasted to the network. However, for the transaction to happen, it needs to be confirmed.

The confirmation is done by miners (special nodes). As discussed earlier, proof of work is required (processing time by a computer) to place a transaction in a block. The proof of work in Bitcoin transactions is the hash. Miners solve a cryptographic puzzle and whoever solves it first is rewarded.

When a solution is found it is broadcast to the network and the nodes individually check the solution. If a majority of nodes approve the solution (using electronic consensus), the transaction is approved and placed in a block.

Each node on the network updates its database and once the transaction is confirmed it cannot be reversed or changed.

The Blockchain has rules programmed into it that are called protocols. Although the system is autonomous (a secure, distributed, peer-to-peer ledger) the protocols ensure that the network runs smoothly and prevents situations where disagreements on the legitimacy of transactions and balances can arise.

The use of advanced cryptography ensures that there is consensus (without a centralized authority) by making the process trustless and devoid of third parties.

A unique property of most cryptocurrencies is that there is a limit to their supply. For example, the number of Bitcoins is limited to 21 million.

Cryptocurrencies can be mined for profit, used as an investment or to buy goods and services. The acceptance of cryptocurrencies is gaining mainstream momentum with a successful transaction on blockchain between the central banks of Singapore and Canada reported on May 2, 2019.

Smart contracts

A smart contract is basically a self-executing digital contract that does not need a third party like a lawyer.

The terms of the contract are agreed between a buyer and a seller and then written directly into lines of computer code. This is then placed on a blockchain.

Being a distributed, decentralized network, the Blockchain is accessible to all parties to the contract. There’s no point of paying a lawyer to be an intermediary in this process.

A smart contract clearly stipulates the rules and penalties of the agreement in a similar way to a traditional contract. The difference in this case is that these obligations are enforce electronically.

The Blockchain or decentralized ledger stores and replicates the contract so that it is available to everyone. The three principles of Blockchain are utilized in this case, giving the contract a high level of transparency, security and immutability.

One of the leading public blockchain platforms specializing in smart contracts is Ethereum. It has the most advanced coding for processing smart contracts that are paid for using ETH tokens.

The use of smart contracts is applicable across diverse sectors of the economy. The following are some areas where they can be executed.

Preventing Financial Crime

The transparency of Blockchain technology gives it an edge in tackling money laundering. The record of transactions in a Blockchain cannot be altered and provides permanent proof of an activity.

This means that the tactics used by money launderers to hide proceeds by opening dummy accounts and shell companies cannot be tolerated in a Blockchain system where transactions are completely open and the record is immutable.

Financial institutions will be able to implement know your customer (KYC) practices with ease in a transparent distributed ledger.

Stock Markets / Derivatives

A lot of inefficiencies exist in today’s stock market where trades are settled after three days. The use of blockchain can be a solution to such delays because it utilizes smart contracts which can be completed in seconds.

In a blockchain, trades are conducted peer-to-peer without going through a broker, custodian, clearing house or any other intermediary.. The transaction is therefore instantaneously executed and the record posted.

This would streamline the process by automation which in turn reduces the costs of derivatives trading.

Some stock exchanges are trying some form of blockchain applications for their services. It may take some time for the technology to be adopted but when it is finally perfected it may require the collaboration of banks.

Peer-to-peer trading will revolutionize stock trading and make processes more efficient.

Insurance

Blockchain technology can be used to execute automatic payments when certain conditions are met. Users would be required to submit their claims online and the system would check whether they meet specific criteria and this would trigger immediate payment.

The system uses smart contracts to process payments and store immutable records of the transactions. This would eliminate the need of intermediaries like banks or insurance brokers. AXA, the French insurance giant’s adoption of smart contracts for flight delay insurance is among the early examples.

Automobile insurance companies may in future use smart contracts to determine the different rates to charge by automatically detecting the conditions under which the vehicles are driven.

Elections and governance

The use of smart contracts in elections and polls is critical for fraud to be eliminated. The distributed nature of blockchain ledgers provides the much needed transparency and underlying cryptography ensures anonymity of votes.

Current trends targeting elections are based on smart contracts developed on the Ethereum blockchain. This technology helps to automate the voting process in a transparent and verifiable way.

It can be implemented in poll taking and even in company governance. A few apps are under development like Boardroom for corporate decision making and TIVI for remote voting.

Although this technology has not been refined for widespread adoption, initial trials of remote voting in Estonia using TIVI have been largely promising. Such a system covers four main areas of interest for election management:

- Identity management – the system must ensure that only eligible voters can have access and cast their votes. Eligibility and authentication are critical in such a process.

- Privacy – the use of cryptography not only provides voter privacy but the necessary anonymity.

- Security – a distributed ledger has the records validated across the network. The security of the process ensures that nobody can tamper with the vote which eliminates cases of fraud.

- Transparency – The decentralized system is accessible to all players which ensures unprecedented election transparency.

Internet of Things (IoT)

As the world moves towards full connectivity, Blockchain can be effectively used in the implementation of the Internet of Things across networks. IoT is a network of electronic devices powered by software and sensors and is controlled remotely.

Such system efficiency is possible through smart contracts built on blockchain technology where the collection and exchange of data happens.

For example, a network on blockchain can be used to control lighting systems (to switch on and off when certain conditions are met) or manage a process in a factory.

The use of cryptography and decentralization in blockchain would prevent a hacker from disrupting the process in a factory or the setup in a home.

The emergence of IoT is gaining momentum with the major players like Samsung, AT&T, Amazon and others taking a lead in carving out a niche for themselves. Devices produced by these companies are preinstalled with software that enables them to communicate with each other.

Smart contracts are central in enabling such automation of remote systems and mechanisms of managing them to reduce the cost of monitoring.

Record keeping / Data management

Land title registration

Land or property titles are important documents which are prone to fraud. A visit to the land registry will provide insight to how managing such records is tiresome and expensive.

Several countries including Georgia and Sweden are pioneering initiatives to try and develop Blockchain systems to manage property titles and streamline land registries.

If these experiments succeed, we shall see widespread adoption of this technology in bringing efficiency to management of titles. A distributed ledger which is publicly accessible can make the administration of land registries transparent and prevent incidents of fraud.

Data storage and management

The advent of cloud computing has revolutionized the way data is stored. Services like Dropbox, Google Drive, Microsoft OneDrive offer data storage for companies and individuals in remote servers accessed through the internet.

The services offered by these companies are centralized and are susceptible to attacks by hackers. A network outage can also cause major disruptions to such systems.

Blockchains can still use cloud storage but in a decentralized fashion to mitigate the threat posed by hackers and also ensure continuous accessibility because the data is not stored centrally but updated copies are distributed across all the nodes on the network.

Services such as Storj and Ethereum Swarm are pioneering in this technology involving decentralized cloud storage.

Identity management and verification

Blockchain technology provides a decentralized system that can make identity verification not only efficient but secure. Decentralization makes data incorruptible on the blockchain and eliminates the threat of hacking common in centralized systems.

Several real-life applications have been pioneered and are showing great progress. For example, the Swiss city of Zug verifies its citizens’ electronic identities using a decentralized application (DApp). The results have been phenomenal and the city is considering the use of Blockchain for the voting process.

The security and transparency of blockchain will bring new dimensions to identity management and eliminate cases of identity theft.

The Sharing Economy

The sharing economy has experienced a boom in recent years with companies like Uber pioneering in this space. This sector still depends on intermediaries to link the parties involved.

Blockchain is implemented on a peer-to-peer mechanism which can enable the parties involved to create direct payments to each other without using a third party. This will not only bring efficiency but lower the overall cost and bring greater benefits to players in a decentralized sharing economy.

Protection of Intellectual Property

The advent of the internet has been of great benefit to content consumers and creators in equal measure. However, content creators have more often than not lost control over their creation. Copyright infringement is widespread across the web leading to frustration and financial ruin among copyright holders.

The use of blockchain and specifically smart contracts, can automate the sale of copyrighted works online by triggering the sale when certain conditions are met. This will remove the possibility of consumers redistributing or copying creative works and hence protecting copyrights.

Such peer-to-peer distribution of content would for example, enable musicians to sell songs directly to consumers without using third parties. This would reduce the cost of distribution and create more revenues for artists.

Blockchain archiving can also provide protection for intellectual property by ensuring immutable records are kept securely. Applications based on Blockchain may provide permanent records to protect copyrighted material.

Vulnerabilities of Blockchain

Blockchain has been touted as a solution to some of the problems ailing various sectors. Security of networks, fraud and transparency of financial transactions, centralized third-party control of financial systems and identity theft are some of the issues that can be addressed by blockchain technology.

While Blockchain has great potential, there are some concerns on how full-proof this technology is and this has hindered its widespread adoption.

The technology may lose its basic principle of decentralization if a hacker or other entity manages to gain control of a large number of the network’s nodes. This would be disastrous.

Another concern is the possibility of smart contracts that may be hijacked by malicious actors. Malicious code can be used to trigger such contracts to the detriment of the parties concerned. Regulatory framework for such contracts is also a concern for adopters.

Blockchain networks are yet to develop the required complexity to handle huge financial transactions similar to the big banks and card issuers. However, the momentum seen with cryptocurrencies may lead to further development of Blockchain and its mainstream adoption.

Conclusion

The excitement around Bitcoin and other cryptocurrencies has captured the imagination of people around the world. This has caught the attention of governments and the interest of a lot of companies within the technology sector and other industries as well.

Governments are already mulling on regulatory frameworks to govern this new economy. As we have seen earlier, even central banks are embracing Blockchain.

The big retailers and most online merchants are beginning to accept cryptocurrencies as legitimate modes of payment.

Big firms like Google are investing in Bitcoin and some countries like Estonia are already implementing Blockchain technology in their election processes to improve on transparency and security of votes.

The potential use of Blockchain across various industries is not in doubt. What is remaining is for the proper infrastructure and investment in systems that can tap into this technology and define a new dispensation in security and transparency. Projects such as ascribe, which was meant to protect intellectual property in the digital world, haven’t taken off due to limited blockchain infrastructure to enable scaling and the envisaged user experience.